sales tax rate tucson az 85713

Arizona Department of Revenue -. The following are the tax rate changes effective February 1 2018 and expiring January 31 2028 Use the State of Arizona Department of Revenues Transaction Privilege.

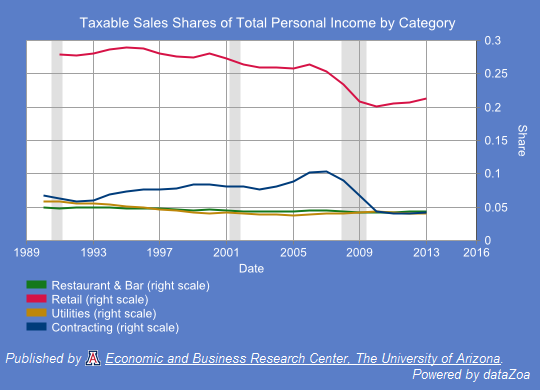

Arizona S Eroding Sales Tax Base Arizona S Economy

The estimated 2022 sales tax rate for zip code 85713 is 870.

. This rate includes any state county city and local sales taxes. Find the best deals on the market in Tucson Az 85713 and buy a property up to 50 percent below market value. There is no applicable special tax.

Tucson Az 85713 tax liens available in AZ. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. The Arizona sales tax rate is currently.

Arizona has state sales. Shop around and act fast on a. Tucson is located within Pima County.

This is the total of state county and city sales tax rates. Search for Product Service or Business Name. The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation.

The minimum combined 2022 sales tax rate for Tucson Arizona is. Average Sales Tax With Local. The current total local sales tax rate in Tucson AZ is 8700.

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. 2020 rates included for use while preparing your income tax deduction. View sales history tax history home value estimates and.

TBD TBD -- Unit - Tucson AZ 85713 7250000 MLS 6475462 Gorgeous 80 acre parcel adjacent to Tucson Mountain Park with fabulous views in all. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Tucson AZ. The average cumulative sales tax rate in Tucson Arizona is 801.

The minimum combined 2022 sales tax rate for Tucson Arizona is. Lowest sales tax 56 Highest sales tax 111 Arizona Sales Tax. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and.

Groceries and prescription drugs are exempt from the Arizona sales tax. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a. The sales tax jurisdiction.

Multi-family 2-4 unit located at 2814 S Coconino Vis Tucson AZ 85713 sold for 78000 on May 10 2016. Tucson AZ 85713. Zip code 85713 is located in Tucson Arizona and has a.

The latest sales tax rate for Tucson AZ. This includes the rates on the state county city and special levels. 2022 List of Arizona Local Sales Tax Rates.

This includes the rates on the state county city and special levels.

Report Unfair Arizona Tax System Unduly Burdens Poor Residents Cronkite News

Sales Tax Rates In Tucson And Pima County Pima County Public Library

Arizona Sales Tax Relatively High Many Valley Rates Mostly Stable

Arizona Sales Tax Small Business Guide Truic

Report Pima County Has Highest Property Tax Rate In Arizona Azpm

Complete Guide To Arizona State Income Tax Payroll Taxes

Manage Sales Tax For Us Locales

Location Based Reporting Arizona Department Of Revenue

1421 S Bristol Ave Tucson Az 85713 Realtor Com

Tucson Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Arizona Collected Extra 52m In Online Sales Tax In First 2 Months Of New Law Local News Tucson Com

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

List Of 6 Arizona Tax Credits Christian Family Care

Prop 411 Tucson Votes To Extend Half Cent Sales Tax In Special Election The Daily Wildcat

1 Arizona Sales Tax Use Tax Chunyan Pan Tax Manager Financial Services Office Ppt Download

85713 Real Estate 85713 Homes For Sale Zillow

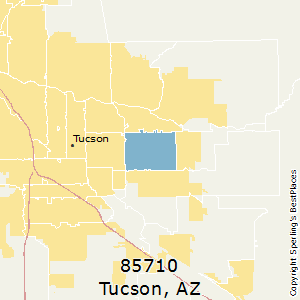

Best Places To Live In Tucson Zip 85710 Arizona

Sales Tax Rate Changes For 2022 Taxjar

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation